The ROI Case Your CFO Can't Ignore

Why data governance isn't a cost center but is a profit protection strategy

S called me last week with a problem.

“I used your cost calculator. Ran our numbers. We’re bleeding almost $800,000 a year on data quality issues.”

“That’s a big number,” I said.

“That’s the problem. It’s too big. When I showed my CFO, she didn’t see an opportunity. She saw a disaster. Her first question was ‘How did we let this get so bad?’ Her second question was ‘How much will it cost to fix?’”

S paused.

“I didn’t have an answer.”

The CFO’s Real Question

Here’s what I’ve learned after 25 years in this space: executives don’t fund problems. They fund solutions with returns.

Showing your CFO that bad data costs $800,000 annually doesn’t get you a budget. It gets you a meeting where everyone argues about whose fault it is.

What gets you a budget is showing that a $150,000 investment returns $500,000 in the first year.

That’s not a problem. That’s a 233% ROI.

The Math That Changes the Conversation

Let me show you how to reframe the data quality conversation from “look how broken we are” to “look what we can capture.”

Step 1: Start with your cost calculator numbers

Let’s say your organization identified:

$312,000 in rework costs (data teams cleaning instead of analyzing)

$450,000 in failed project costs (3 projects that never delivered)

$200,000 in bad decision costs (choices made on flawed data)

$12,000 in compliance documentation time

Total: $974,000 annually

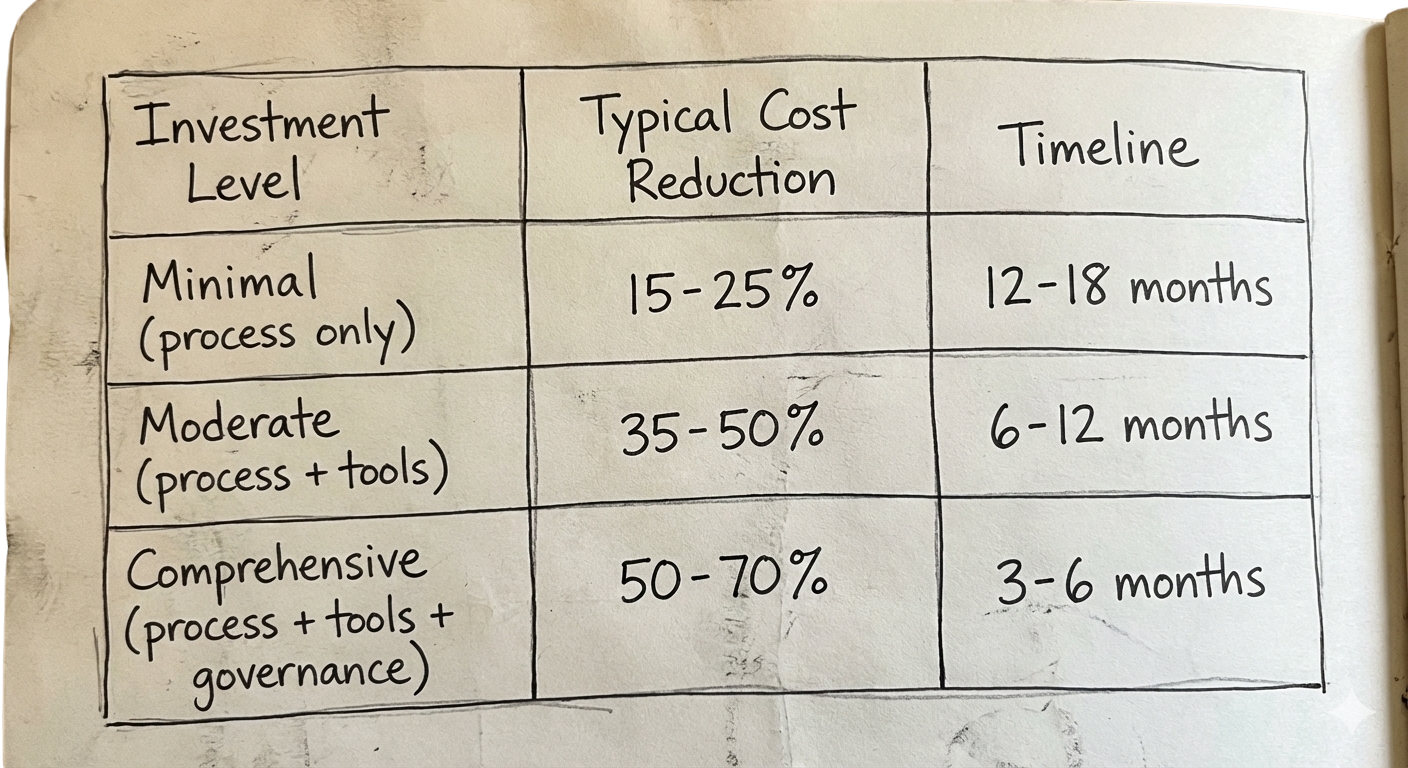

Step 2: Apply realistic reduction rates

You won’t eliminate 100% of these costs. But industry benchmarks show:

Step 3: Calculate the return

Using moderate investment on our $974,000 example:

Cost reduction (40%): $389,600 saved annually

Investment required: $120,000 (tools, training, dedicated resource)

First year net return: $269,600

ROI: 225%

Payback period: 3.7 months

That’s the slide your CFO wants to see.

The Costs They’re Not Counting

When I work with organizations, I always find costs the calculator missed. These are harder to quantify but often larger:

Opportunity cost. Your data scientists spend 50% of their time cleaning data. That’s not just a labor cost - it’s innovation that never happened. Products that never launched. Insights that never surfaced.

Decision latency. When leaders don’t trust the data, they delay decisions. They ask for “one more analysis.” They convene committees. In fast-moving markets, slow decisions are expensive decisions.

Talent attrition. Good data professionals don’t stay at organizations with bad data infrastructure. The cost of replacing a senior data scientist - recruiting, onboarding, ramp-up time - runs $150,000 to $300,000.

Insurance premiums. This one surprises people. D&O insurance carriers are starting to ask about AI governance. Poor data governance is becoming an underwriting factor. I’ve seen premiums increase 40-60% for organizations that can’t demonstrate controls.

Regulatory exposure. The EU AI Act penalties can reach €35 million or 7% of global revenue. GDPR fines have already exceeded €4 billion total. These aren’t theoretical risks anymore.

Building the Business Case

Here’s the structure that works:

Page 1: Current State (The Burning Platform)

Don’t lead with this, but you need it. Show the calculated costs. Keep it factual, not accusatory. Frame it as “what we discovered” not “what went wrong.”

Page 2: The Opportunity (This Is Your Real Opener)

Lead with the ROI. “A $120,000 investment yields $389,600 in annual savings - a 225% return with 3.7 month payback.”

Now you have attention.

Page 3: Risk Reduction (The Insurance Policy)

Beyond cost savings, governance reduces:

Regulatory penalty exposure

Reputational risk from AI failures

D&O insurance premium increases

Audit findings and remediation costs

Quantify what you can. Acknowledge what you can’t but name the risks.

Page 4: Competitive Advantage (The Growth Angle)

Organizations with mature data governance:

Launch AI initiatives faster (they trust their data)

Win more RFPs (they can answer the governance questions)

Attract better talent (professionals want to work with good data)

Command premium valuations (acquirers and investors check this now)

Page 5: The Ask (Specific and Staged)

Don’t ask for everything at once. Propose phases:

Phase 1: Assessment and quick wins ($30,000, 6 weeks)

Phase 2: Foundation building ($60,000, 3 months)

Phase 3: Optimization and scaling ($30,000, ongoing)

Smaller initial asks get approved faster.

The Conversation Shift

S called me again yesterday.

“I rebuilt the presentation. Led with the ROI. Showed the 225% return and 4-month payback.”

“And?”

“She asked how fast we could start.”

That’s the shift. Same numbers. Different framing. Completely different outcome.

Your CFO doesn’t need to understand data quality. She needs to understand returns. Speak her language, and the budget follows.

Your Turn

I’ve built an ROI Calculator that structures this entire conversation. It takes your cost calculator outputs and transforms them into CFO-ready business cases.

Includes:

Investment scenario modeling

ROI and payback calculations

Risk reduction quantification

One-page executive summary template

Talking points for the budget conversation

Ok, a quick note on ‘How the Calculator Works’

The math is simple but powerful:

Step 1: Enter your total current cost (from the Data Quality Cost Calculator, or estimate)

Step 2: The calculator shows three investment scenarios:

Step 3: It calculates automatically:

Annual Savings = Your Current Cost × Cost Reduction %

Net Return = Annual Savings - Investment

ROI = Net Return ÷ Investment

Payback Period = Investment ÷ Annual Savings × 12 months

Example: If your current data quality costs are $974,000 annually and you choose moderate investment:

Annual Savings: $974,000 × 40% = $389,600

Net Return: $389,600 - $75,000 = $314,600

ROI: $314,600 ÷ $75,000 = 419%

Payback: $75,000 ÷ $389,600 × 12 = 2.3 months

That’s the slide your CFO wants to see.

Your CFO doesn’t need to understand data quality. They need to understand returns. Same numbers, different framing, completely different outcome.

Try it yourself.

Download: “AI Governance ROI Calculator” and Transform your cost analysis into a CFO-ready business case with ROI modeling, payback calculations, and executive talking points.

Download AI Governance ROI Calculator

Next week: The regulatory reckoning. The EU AI Act, NIST AI RMF, and a wave of state laws are creating deadlines most organizations aren’t ready for. What happens when “we’ll figure it out later” meets “the deadline is now.”

Founder of SANJEEVANI AI. ISO/IEC 42001 Lead Auditor. 25+ years in AI, data, and compliance across HealthTech, FinTech, EdTech, and Insurance. Building METRIS, the quantitative AI governance platform.